- The eBay Community

- Answer Centre

- Selling on eBay

- Govt defers GSTIN for eCommerce sellers...see this

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Govt defers GSTIN for eCommerce sellers...see this

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

27-06-2017 05:53 AM - edited 27-06-2017 05:57 AM

Accepted Solutions (0)

Answers (4)

Answers (4)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

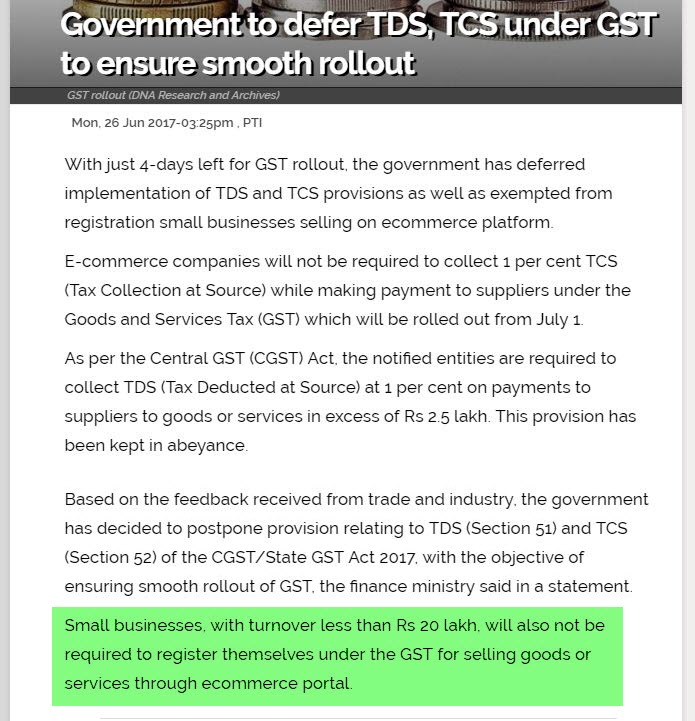

As for latest govt relaxation, problem is that how will e-commerce site determine that a seller has less than 20 Lakh turnover. They will certainly won't go by verbal assurance of the seller.

In most likelihood they will ask the seller to get it in written from bank. This in itself won't be easy especially for sellers who are using savings accounts for e-commerce transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

ebay get intrest in bank , as crores of rupees of seller is hold by ebay , ebay say give GST they will release, were seller dont have GST they will keep hold and make FD in bank of that money ,

ebay can do any think as law in india for these ecommerce is poor.

when government said no GST for small ecommerce seller then also they block payouts, this some think hit how seller can belive in such site, were ebay dont have any belive in seller 1 % also,.

we are paid after order is delivered to customer and customer should be happy , also in powershipping the data is match so that seller dont send they personal shipment in powership

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hope ebay unlock all account whos turnover not 20 lakhs asap